Warehouse File

The Warehouse File designates where physical inventory is stored. You can also use it to designate separate stocking locations or shipping points. Although easily confused with one another, the Warehouse and Branch Files are two distinct files, as well as distinct concepts on the system. Warehouses relate to shipping, picking, stocking and receiving functions. Branches relate to sales and administrative functions.

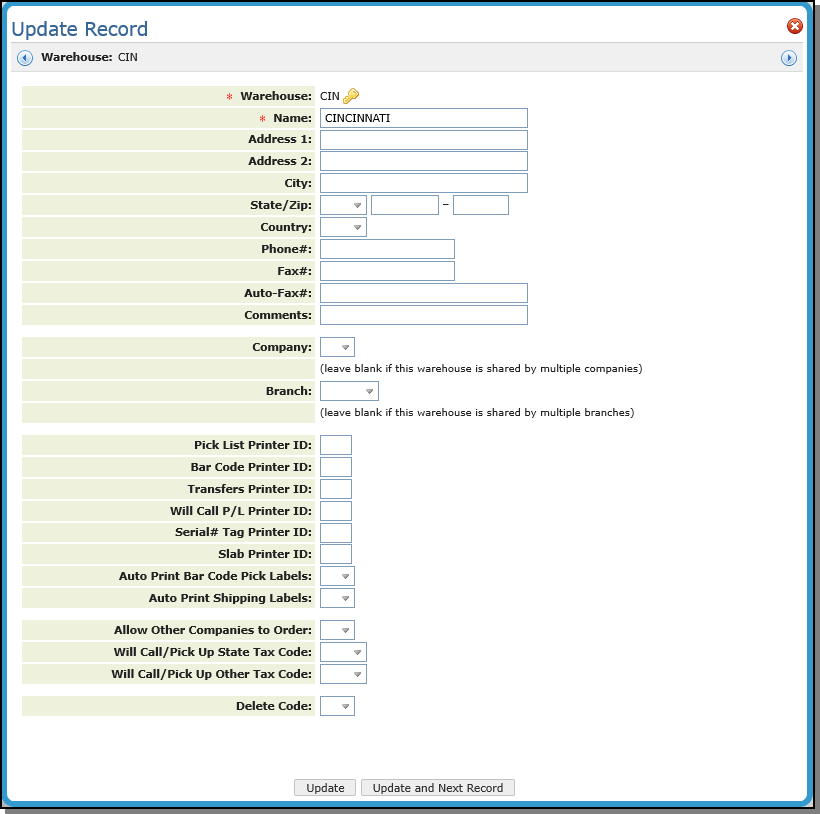

Access the Warehouse File and click Create under Records to create a new Warehouse Record.

| Field Name | Description/Instructions |

| Warehouse | The three character code for the warehouse. |

| Name | Name of the warehouse. |

|

Warehouse Address Addr1 Addr2 City State Zip Country |

Address of the warehouse. If the warehouse is located outside your country, enter the two-character country code here. The warehouse address is used as the Shipto address on your purchase orders to suppliers, unless overridden on the purchase order. |

| Auto-Fax Number | The auto fax number of the warehouse. This field is necessary only if you use the Auto Fax Pick List option for remote warehouses. This field can contain complete dialing sequences, including 9 for an outside line and a comma to indicate a pause. When you enter data in this field, it is assumed that you have installed auto-fax software and that you want all pick lists for this warehouse to be faxed to this warehouse rather than printed on an attached remote printer. |

| Comments | Enter any comments you may have for this warehouse. |

| Company # | This field is important if your business has multiple companies and multiple warehouses. If you enter a company number in this field, the system can associate specific warehouses to specific companies. Leave this field blank only if a warehouse is shared by more than one company. Inventory value for a company is determined by adding the value of all warehouses that specify that company number in this field. You will usually enter a specific company number here for each warehouse. However, if a warehouse has been set up for consigned goods, you can assign a non-existent (fake) company number in order to exclude the value of the consigned material from the total inventory value of the actual company. This is the recommended method of excluding consigned inventory values from your regular company figures. |

| Branch # | The branch number to which the warehouse belongs. Leave blank if the warehouse is shared by multiple branches. This field is for reference only. |

| Pick List Printer ID | Any pick list generated to this warehouse is automatically routed to this printer. This overrides the printer ID set up in the Control Panel. This permits printing order acknowledgments on a different printer than the pick lists are printed on, even if you press F4 to print both documents at the same time. You can enter XX, or other code, that is not an actual printer. This indicates that pick lists, other than for will call orders, should not be printed. |

| Bar Code Printer ID | If you activate any of the bar code print options, you must enter a valid printer ID for each warehouse. This printer ID must relate to a printer capable of printing bar code labels. |

| Transfers Printer ID | Any stock transfer pick lists generated to this warehouse will automatically be routed to this printer. It is essential for this field to be entered for each warehouse if you use the Stock Transfer system. |

| Will Call P/L Printer ID | The ID for the printer you want the will call pick lists to print to. Any pick list generated to this warehouse is automatically routed to this printer. This overrides the printer ID set up in the Control Panel. This permits printing order acknowledgments to be printed on a different printer than the pick lists are printed on, even when you print both documents at the same time. |

| Serial# Tag Printer ID | The ID of the printer on which you want the serial number tags to print for this warehouse. This is an optional feature for rolled goods. During the receiving process, a serial number tag can be printed either on paper, card stock, or on a bar code label. |

| Slab Printer ID | The ID of the printer where you want slab labels to print. Keep in mind that a slab printer is needed for printing slabs. |

| Auto Print Bar Code Pick Labels |

Specifies if you want bar code pick labels to print automatically for each pick list. These controls are separate for each warehouse. Some warehouses may be not equipped to handle bar code labels. You can also print bar code labels on demand using the options as listed on the Warehouse Functions Menu. This option is part of the overall bar coding system which must first be activated by KerridgeNC or your data processing department. The following are valid values for this field:

|

| Auto Print Shipping Labels | Valid values are Y, N, O, T. It will be activated if you require two automatic labels for each line item, one for picking and a separate label for shipping. Currently the pick label serves both purposes. |

| Allow Other Companies to Order |

N prevents customers assigned to other companies from placing orders or holding stock against this warehouse. Y allows all customers to access the warehouse. For example, if the warehouse is assigned to Company 2, customers in Company 1 cannot place orders against the warehouse unless you specify Y. This does not prevent you from inquiring into a warehouse's stock. This parameter is applicable only if you have multiple companies and the Warehouse File contains company number assignments. The default is Y. |

|

Will Call/Pick Up Other Tax Code State/Other |

These fields should be completed only for warehouses that require a certain tax rate for will call (pick up) orders which overrides the tax codes in the for the taxable sales. For example, if when picking up an order, a customer who normally pays certain county tax rates must instead pay the tax rates related to your warehouse location, then you should enter the tax codes for your warehouse location here. Space is provided for both the state and other tax codes. These tax rates are used only under the following circumstances:

Before you use this feature, be sure to update the Classification Codes File ship via records. Each ship via code update screen asks, Does this code represent a pickup or will call? Respond Y or N, as appropriate. This causes the Order Entry and Order Changes program to automatically adjust the tax codes based on the warehouse and ship via codes. Canadian users should make sure your tax code for GST (usually GS) is entered in all warehouse records that will use this feature. Enter it in the Other Tax field. |

Associated Files

Delivery System and Transportation Planning

Item Statistics By Warehouse File - FIL 20

Product Line Statistics By Warehouse File - FIL 21

Warehouse Will Call Tax Table - FIL 42

Warehouse Price List Cross Reference Table - FIL 41

Supplier/Product/Warehouse Table - FIL 45

Options for Pricing by Warehouse